Asian Heritage in Canada

For Canada, Asia does not exist “over there.” It is, has been, and will continue to be, right here, contributing to and shaping our country. Canada’s citizenry includes over 7.5 million people — almost 22 per cent of the population — who were born outside Canada. Recent immigrants to this country are more likely to have come from Asia and the Middle East than from Europe. Chinese ancestry, East Indian ancestry and Filipino ancestry are among the 20 most common ancestries reported by the Canadian population. (Census of Canada, 2016).

Featured Articles

Timelines

Asia-Canada

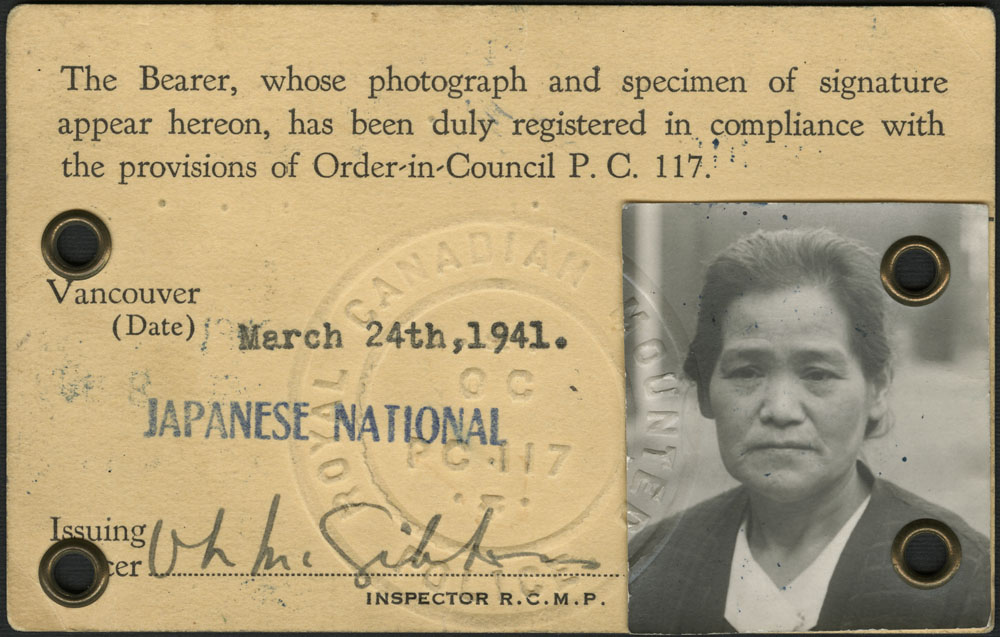

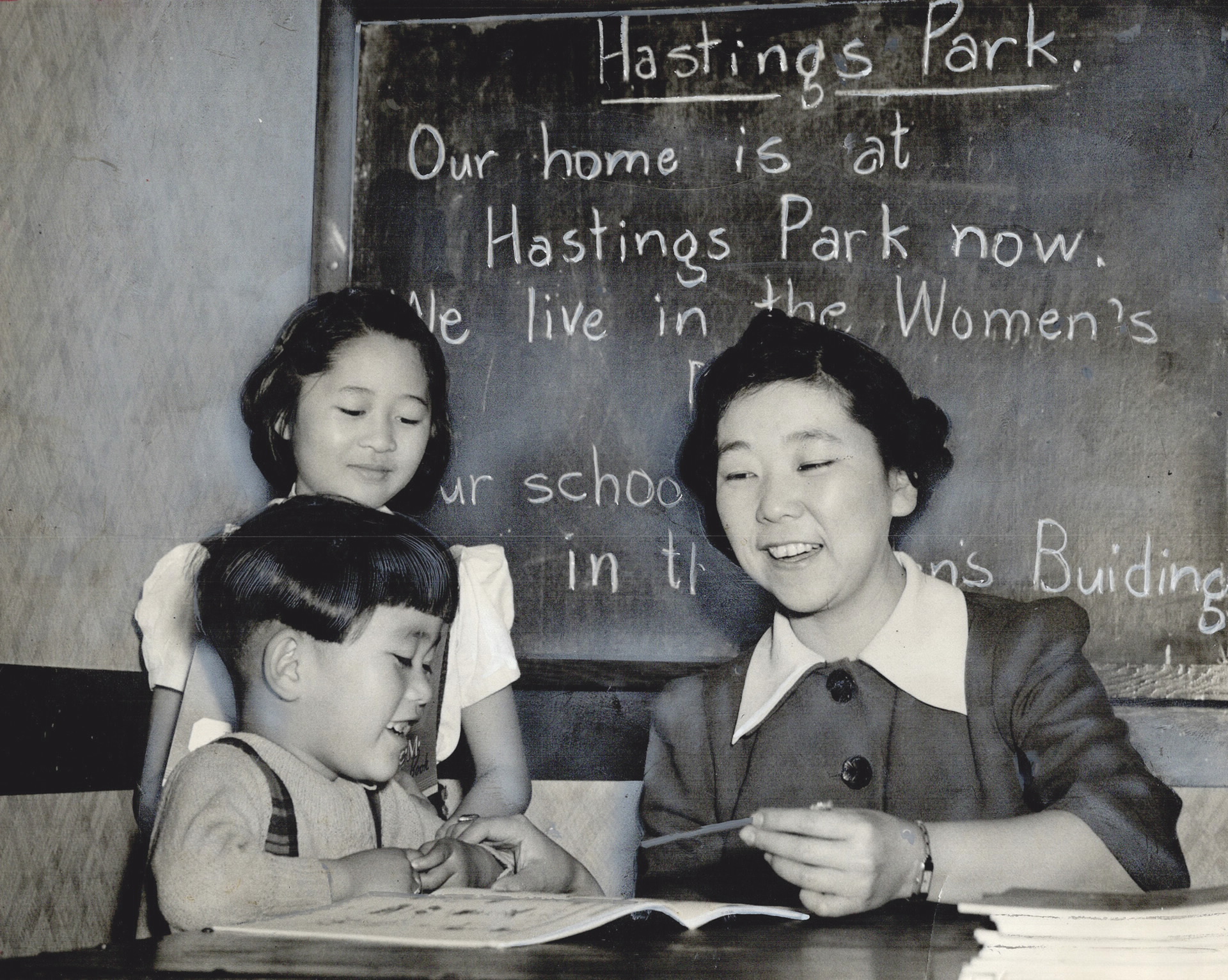

The Asia-Canada timeline presented here is a chronological record of over 200 years of history since the first Chinese settlers helped build a trading post in Nootka Sound. The timeline touches on the settlement history of various Asian groups, the discrimination that many suffered in our early history, accomplishments, firsts, biographies, and the gradual changes through which Canadian society came to accept the rights and equality of its Asian immigrants.

Quizzes

Gallery

Videos